A Core Banking System That Will Streamline Your Operations

With streamlined processes and advanced features, you can elevate your banking services and enhance customer experience.

Don't Let Inadequate Software Hold You Back

It's time to make the smart choice for your institution and embrace a core banking system that will redefine the way you do business.

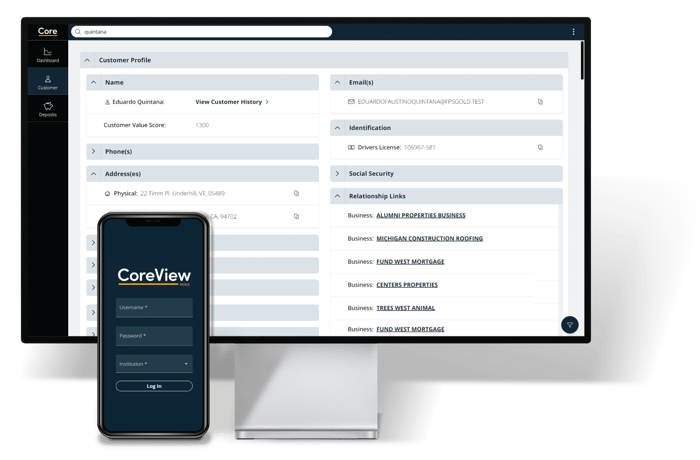

Banking CRM

Maximize the use of existing information and streamline your relationship-banking processes with our powerful customer relationship management tool.

POPULAR FEATURES INCLUDE

- Customer Profitability

- Fully Integrated

- Combine Customer Data

Teller System

Integrated with customer information, lending, deposit, digital banking, and accounting systems, our teller platform provides you with a seamless tool to service your customers.

POPULAR FEATURES INCLUDE

- Customizable Transactions

- Integrated

- Teller and Branch Capture

Accounting

The accounting product suite includes accounts payable, fixed assets, and payroll management systems that post in real time to a powerful General Ledger application.

POPULAR FEATURES INCLUDE

- Excellent Financial Reporting

- Rapid General Ledger Entries

- Flexible Year-end Closings

New Account Opening

Whether an application is made online or in person, our system walks you through the process of opening an account. Customer verification, check ordering, document imaging, and signature capture work seamlessly with the new account platform.

POPULAR FEATURES INCLUDE

- Open Any Type of Deposit Account

- Customized for Your Institution

- Sales and Compensation Tools

Deposit Servicing

The deposit system provides you with the information you need to make the right decisions at the right time. Key features—including savings, checking, retirement, and certificate functions—give you tools to quickly serve your customers.

POPULAR FEATURES INCLUDE

- Commercial Account Analysis

- Positive Pay

- Easy Savings

Loan Servicing

Provide your customers with commercial, consumer, construction, or mortgage loans. Calculation of interest, amortization schedules, investor reporting, and more allow you to customize your customers' lending needs.

POPULAR FEATURES INCLUDE

- Irregular Payment Schedule

- Loan Payment Reversal

- Construction Loans

.png?width=200&name=stock-market-2%20(1).png)

Custom Reports

Having a complete understanding of your commercial and consumer customers allows your institution to create a targeted plan to maintain profitability and relationships. This is why you get quick access to your institution's data and analytics through our customizable reports, the second you need them.

POPULAR FEATURES INCLUDE

- Executive Dashboard

- Data from Multiple Time Cycles

- Ad Hoc

What Customers Say About Our Core Banking Software

-

"The change from Fiserv to FPS GOLD was a great move because of all the added functionality and the client support we receive from staff and our account manager. Our account manager advocates for our needs and is responsive to our requests."

Ricardo Perez

President and COO -

"We chose FPS GOLD due to the company's focus on customer service which is in line with our focus. FPS GOLD employees have been available at any given time we've needed them. You can't find that kind of service from a Core these days."

Kristina Keys

VP/Retail Operations Manager -

"We chose FPS GOLD over the alternative because they were a smaller company and could relate to our small community bank. We have built a relationship on mutual trust and been able to keep the relationship strong and growing by being honest when we are frustrated and celebrate successes as they happen. Knowing who you are doing business with is a huge thing for us. We like to know our processor and have them know and understand what we are looking for and why."

Emily Nelson

Deposit Operations Manager -

"FPS GOLD is open to programming enhancements and can customize screens and functionality for each of their clients."

Jodi Baldwin

VP Operations

How It Works

1. See it in Action

2. Explore Pricing

3. Enjoy

Watch your institution compete, profit, and thrive.

Ready to Get Started With Core Banking?

Fill out the form and we'll be in touch very soon.